Counsel as co-pilot

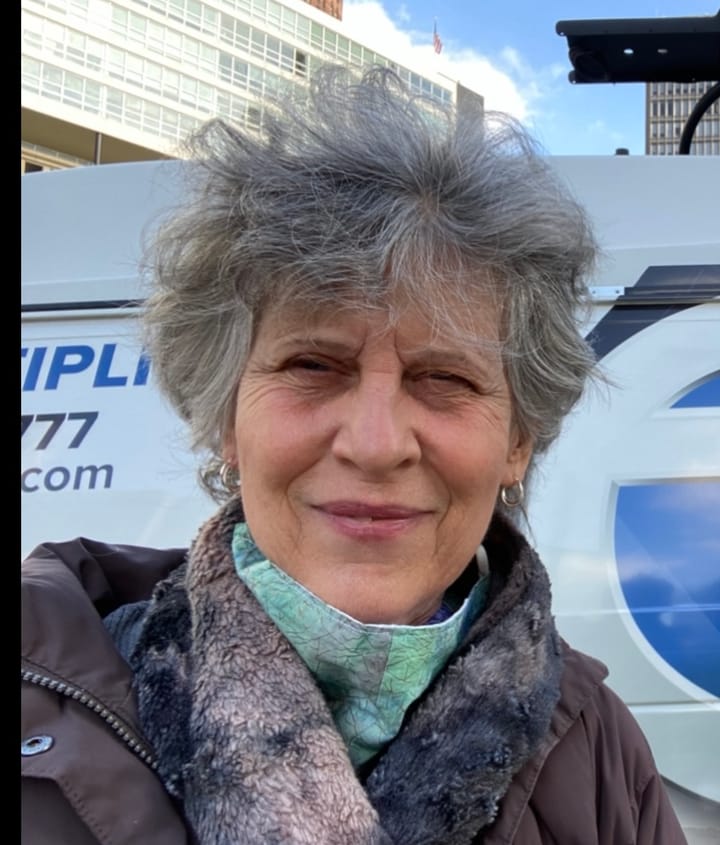

Aviation tax attorney Letisha D. Sailor guides businesses and high-net-worth clients through the turbulent airspace of tax planning and compliance.

A version of this story first appeared in the Raise the Bar newsletter. To get it in your inbox, sign up for free by clicking here.

By Emily Kelchen | for Raise the Bar

Private jets and corporate aircraft conjure images of speed and convenience, but behind the scenes, they’re magnets for red tape and complex legal questions. This week, we’re talking with Letisha D. Sailor, an aviation tax attorney. She and her team at AvTax Advisors guide businesses and high-net-worth clients through the turbulent airspace of tax planning and compliance.

How did you get into such a niche practice? It’s not something I was pitched on in law school!

It had to be destiny at work. I knew I wanted to be an attorney since second grade after falling in love with Perry Mason and Matlock. Then I fell in love with tax at the age of 13 when I prepared my parents’ tax return using the instruction books from the local post office. In law school, I learned that I could do both. I obtained an LL.M. in corporate tax and started my legal career in corporate tax.

I ran into a former classmate at a bar function who was working in aviation law and his work really piqued my interest. Less than a year later, I saw an employment ad for an aviation tax law firm and decided to take the leap. I haven’t looked back and could not see myself working in a non-aviation related practice area.

What’s the most surprising or unusual matter you’ve worked on involving aircraft?

I’m unable to answer this one with detail, but I will say that failed businesses and relationships can lead to interesting legal disputes over aircraft.

Fair enough! How about we get into the weeds on tax law instead? Is it the IRS or the states that give you the most headaches?

It depends. Tax enforcement, audits and other agency compliance measures ebb and flow. There are a lot of variables at play, including understaffed agencies and staff with very little aircraft expertise.

State audits and assessments of aircraft owners are currently on the rise. I am also seeing state taxing agencies taking positions and proposing regulatory changes that could have significant tax consequences for aircraft owners and operators.

I assume you collaborate with others on most of your matters. What’s the secret to doing that well when you are hyper-focused on one issue, but your clients have a lot more than that going on?

The first step is to understand the client’s objectives and delegation of duties amongst the client’s team to meet those objectives. Then it’s all about keeping an open line of communication and managing expectations.

Because we have to strictly follow laws under multiple regulatory frameworks, structuring the ownership and operation of an aircraft is not like any other business asset. We cannot always accomplish tasks in a way the client or another member of the client’s legal team proposes. So, we need them to trust that we know what we are talking about when we flag an issue or suggest something be done differently.

You're all caught up!

Thanks for reading today's edition! You can reach the newsletter team at raisethebar@mynewsletter.co. We enjoy hearing from you.

Interested in advertising? Email us at newslettersales@mvfglobal.com

Was this email forwarded to you? Sign up here to get this newsletter every week.

Raise the Bar is written and curated by Emily Kelchen and edited by Bianca Prieto.

Comments ()